A local mortgage broker in Rochford can make this process straightforward and efficient. With access to a wide range of lenders, they can provide personalised advice tailored to your circumstances, helping you find the best rates and terms available.

Using a local mortgage broker gives you an advantage. They have in-depth knowledge of the Rochford property market and can offer exclusive deals that are often unavailable when approaching lenders directly. Whether you need help as a first-time buyer or want advice on equity release options, a broker ensures the process is simple, clear, and stress-free.

Benefits of Working with a Mortgage Broker:

- Tailored advice for your unique financial situation.

- Access to mortgage deals not directly available to the public.

- Support with paperwork and navigating lender requirements.

- Expert advice on government schemes like Shared Ownership or Help to Buy.

Rochford: A Wonderful Place to Call Home

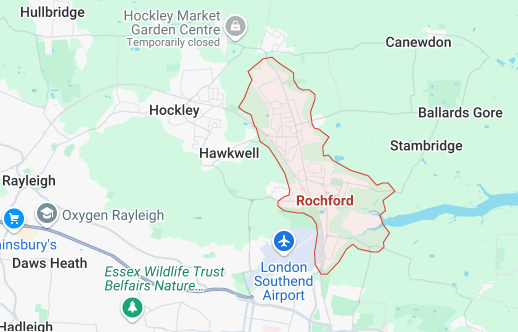

Located in Essex, Rochford offers a balance of rural charm and modern convenience. Its historic town center, excellent transport links, and family-friendly amenities make it a sought-after location.

Key Features of Rochford:

- Rich History: Rochford’s heritage is evident in its architecture, including the medieval Rochford Hall.

- Great Transport Links: Rochford is on the Southend branch of the Greater Anglia railway line, offering direct connections to London Liverpool Street. The town is also close to the A127 and A130, making it ideal for commuters.

- Thriving Community: From local markets to green spaces like Cherry Orchard Jubilee Country Park, Rochford has something for everyone.

Housing Market in Rochford

Rochford boasts a variety of housing options, from period homes to new developments. Property prices here remain competitive compared to London, attracting families, professionals, and retirees alike.

For further insights, check out our guide: “How Mortgage Brokers Simplify the Homebuying Process.”

For homeowners aged 55 and over, equity release or later-life mortgages can provide financial flexibility. These options allow you to access the value tied up in your property to fund retirement, home improvements, or support your family.

Equity Release Options:

Lifetime Mortgages: Borrow against your home’s value while retaining ownership. Repayment is made when the property is sold.

Home Reversion Plans: Sell a portion of your home to a lender in exchange for a lump sum or regular payments while continuing to live there rent-free.

Later-Life Mortgages:

These plans are designed for older homeowners who wish to borrow while retaining full ownership. Popular options include interest-only mortgages, which allow you to pay interest during the term and repay the capital when selling the property.

Nearby Towns to Consider

If you’re considering surrounding areas, here are some great options to explore:

Just 4 miles from Rochford, Rayleigh offers excellent schools, vibrant shopping, and a historic high street.

Known for its seaside attractions and nightlife, Southend offers urban living with coastal charm.

A quieter village setting with good transport links, perfect for families seeking a peaceful lifestyle.

Plan Your Move with Mortgage Brokers in Rochford

Rochford is a unique and welcoming town that combines affordability, charm, and convenience. Whether you’re buying your first home, remortgaging, or exploring equity release, the right mortgage brokers in Rochford can help you secure the best deal and achieve your property goals.

Ready to Get Started?

Contact our team today if you’re looking for expert mortgage brokers in Rochford. We’re here to guide you through the process, offering tailored solutions to suit your needs and budget.

Take the next step towards your dream home in Rochford confidently and easily.