This popular Essex town boasts a vibrant community, excellent transport connections, and a mix of historic and modern homes. Finding the right mortgage deal can be challenging with such high demand for properties.

A local mortgage broker offers valuable expertise tailored to the Epping housing market. Their insight ensures you access competitive rates and options suitable for your circumstances. Moreover, brokers understand the specific requirements of lenders, which can streamline the application process.

Additionally, Epping’s unique property market combines period homes and newer developments. This diversity requires careful financial planning to match the right mortgage product to the property type. By consulting with a broker, you can navigate this process more effectively.

Mortgage Brokers in Epping

Transitioning to homeownership, remortgaging, or equity release is a significant financial decision. Therefore, having personalised advice can make a big difference. A professional broker can guide you through affordability checks, application requirements, and lender criteria.

Epping’s proximity to London adds to its appeal and intensifies competition among buyers. Securing the best deal often depends on acting quickly and having expert advice at hand. Working with a mortgage broker ensures you stay ahead, improving your chances of approval.

Local expertise is crucial whether you’re a first-time buyer or a homeowner reviewing your options. Mortgage brokers specialising in the Epping area can provide tailored solutions to suit your needs and budget.

By taking professional advice, you can secure the right mortgage while saving time and effort. Start your journey towards securing your dream home or making the most of your property investment today.

Whether you’re new to the housing market or experienced, understanding the many mortgage options can be daunting. A trusted mortgage broker in Epping can help by:

- Offering expert advice tailored to your financial situation.

- Providing access to exclusive mortgage deals unavailable from banks directly.

- Guiding you through the paperwork and lender requirements.

- Advising on government schemes such as Help to Buy or Shared Ownership.

Their local knowledge ensures they stay informed about market trends in Epping, helping you make confident decisions.

For further insights, check out our guide: “How Mortgage Brokers Simplify the Homebuying Process.”

Why Epping is a Great Place to Call Home

A Blend of History and Modernity

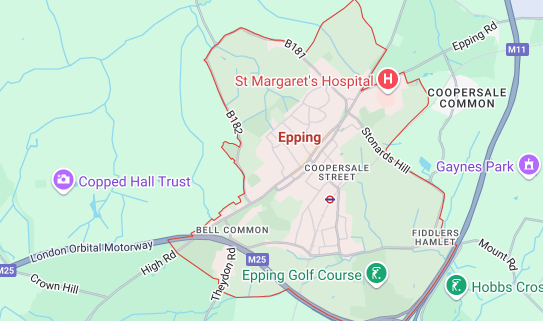

Epping is famous for its unique mix of historical charm and modern amenities. From its bustling high street lined with independent shops and cafes to Epping Forest’s vast greenery, the area offers something for everyone.

Strong Transport Links

Commuting is straightforward with Epping’s London Underground station, connecting directly to the Central Line. By car, the M11 and M25 provide excellent access to surrounding areas and London.

Property Options for Everyone

Epping’s housing market features everything from period homes and cottages to modern apartments and family houses. Property values remain competitive compared to London, making it a great choice for professionals, families, and retirees.

Excellent Local Amenities

Epping boasts top-rated schools, healthcare facilities, and a variety of leisure activities. Whether it’s enjoying Epping Forest, visiting local markets, or dining at high-quality restaurants, the town has much to offer.

For homeowners aged 55 and over, equity release and later-life mortgages can provide financial flexibility. Local brokers in Epping can help you explore these options, ensuring you understand the terms and long-term implications.

Equity Release Products:

- Lifetime Mortgages: Borrow against your home’s value while retaining ownership. Repayment is made when the property is sold.

- Home Reversion Plans: Sell a portion of your home to a lender in return for a lump sum or regular payments, with continued rent-free living.

Later-Life Mortgages:

These allow older homeowners to borrow money while maintaining ownership of their homes. Popular options include interest-only mortgages, which require only interest payments until the home is sold.

Nearby Towns to Consider

If you’re considering options beyond Epping, these nearby towns are worth exploring:

Loughton

Located just a few miles away, Loughton offers excellent schools, great transport links via the Central Line, and a vibrant high street.

Chigwell

Known for its luxurious homes and proximity to London, Chigwell is a prime location for those seeking a mix of modern convenience and suburban tranquility.

Harlow

With a more affordable housing market and strong road and rail connections, Harlow appeals to families and professionals alike.

These towns offer diverse housing options and amenities, making them excellent alternatives or complements to Epping.

Plan Your Move With Mortgage Brokers in Epping

Epping is a unique and welcoming town that combines affordability, charm, and convenience. Whether you’re buying your first home, remortgaging, or exploring equity release, the right mortgage brokers in Epping can help you secure the best deal and achieve your property goals.

Ready to Get Started?

Contact our team today if you’re looking for expert mortgage brokers in Epping. We’re here to guide you through the process, offering tailored solutions to suit your needs and budget.

Take the next step towards your dream home in Epping confidently and easily.