Are you looking to purchase your first home or secure a favourable mortgage deal in Ingatestone, Essex?

This picturesque village offers a blend of historic charm and modern amenities, making it a sought-after location for homebuyers. Partnering with a local mortgage broker can provide tailored advice to help you navigate the mortgage market effectively.

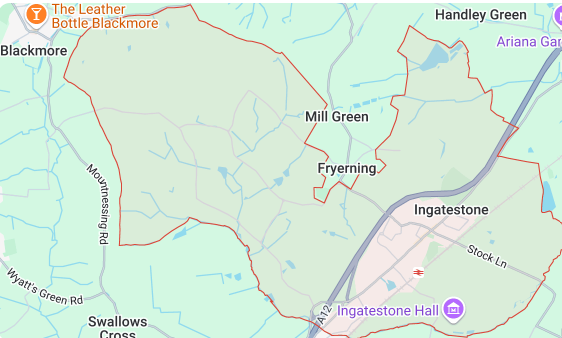

Ingatestone boasts a rich history, evident in its well-preserved architecture and community landmarks. The village offers a variety of properties, from period cottages to contemporary homes, catering to diverse preferences. Its proximity to London and its tranquil rural setting makes it an attractive choice for many.

Transport Links and Local Attractions

Ingatestone is well-connected, with its own railway station providing direct services to London Liverpool Street, making commuting convenient. The village is also close to the A12, facilitating easy road access to nearby towns and cities. Local attractions include the historic Ingatestone Hall and several scenic walking trails, offering residents both cultural and recreational activities.

Nearby Towns to Consider

If you’re exploring options beyond Ingatestone, consider the following nearby towns:

Brentwood:

A bustling town with a vibrant high street, excellent schools, and a mix of property types.

Chelmsford:

As the county city of Essex, Chelmsford offers extensive shopping, dining, and entertainment options, along with efficient transport links to London.

Billericay:

A charming town is known for its community spirit, good schools, and a variety of local events throughout the year.

How a Mortgage Broker in Ingatestone Can Assist You

Navigating the mortgage landscape can be complex. A local mortgage broker can offer:

Personalised Advice: Recommendations tailored to your financial situation and goals.

Access to Exclusive Deals: Opportunities not directly available from lenders.

Assistance with Paperwork: Guidance through the application process to ensure accuracy and completeness.

Insights into Government Schemes: Information on initiatives like Help to Buy or Shared Ownership that may benefit you.

For further insights, check out our guide: “How Mortgage Brokers Simplify the Homebuying Process.”

For homeowners aged 55 and over, equity release or later-life mortgages can provide financial flexibility. These options allow you to access the value tied up in your property to fund retirement, home improvements, or support your family.

Equity Release Options:

Lifetime Mortgages: Borrow against your home’s value while retaining ownership. Repayment is made when the property is sold.

Home Reversion Plans: Sell a portion of your home to a lender in exchange for a lump sum or regular payments while continuing to live there rent-free.

Later-Life Mortgages:

These plans are designed for older homeowners who wish to borrow while retaining full ownership. Popular options include interest-only mortgages, which allow you to pay interest during the term and repay the capital when selling the property.

Consulting with a knowledgeable broker can help you understand these products and determine the best fit for your circumstances.

Take the Next Step

Whether you’re a first-time buyer, looking to remortgage, or exploring equity release, partnering with a mortgage broker in Ingatestone can provide the expertise and support you need. Contact our team today to discuss your options and take a confident step toward securing your ideal mortgage solution.