Later life mortgages are designed for homeowners aged 55 or over (or 50 for specific options). These mortgages let you borrow money against your home’s value while still living in it.

Unlike traditional mortgages, they cater to older homeowners seeking financial flexibility. For some, this can support retirement plans or unexpected expenses. However, these products require careful consideration to ensure they suit your needs.

Importantly, later life mortgages allow you to unlock equity without selling your home. This ensures you can remain in your property. Additionally, some options provide flexibility in how and when the loan is repaid.

With clear terms, these mortgages can be an effective way to manage financial needs in later life. However, it is essential to understand the costs, repayment options, and potential impact on inheritance.

Lifetime Mortgage: A Type of Equity Release

A lifetime mortgage is a secured loan against your home. It provides a way to access funds without needing to sell. With this option, you can choose to make no monthly payments or pay interest monthly with a Payment Term Lifetime Mortgage. However, failure to keep up with payments on a Payment Term Lifetime Mortgage could result in repossession as a last resort.

Typically, the loan and accrued interest are repaid after you die or move into long-term care. This option can help release funds tied up in your property. However, exploring alternative borrowing options that might be cheaper is important. Consulting with a financial adviser could help ensure you make the best decision for your needs.

Retirement Interest-Only Mortgage

A retirement interest-only mortgage is a type of residential loan secured against your property. You are required to make monthly interest payments, while the full loan balance is typically repaid after you pass away or move into long-term care. If payments are missed, your home could be repossessed as a last resort.

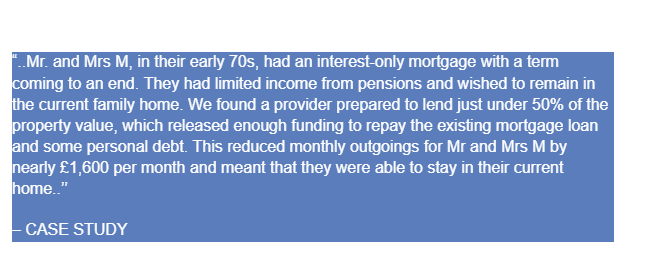

This option is worth considering if you need to release funds from your property to clear an existing mortgage. It provides a way to access equity without selling your home immediately. Many individuals choose this type of loan to improve cash flow during retirement or manage existing financial commitments.

These mortgages are suitable for homeowners seeking stability in later life. Unlike standard interest-only mortgages, there is no fixed term, as repayment is tied to life events such as moving or passing away. However, affordability checks will be carried out to ensure you can meet the interest payments.

Lenders often require applicants to be a certain age, typically 55 or older, to qualify. Furthermore, the property value and your income will determine the amount you can borrow. For couples, both partners usually need to meet the eligibility criteria.

Before deciding, it’s essential to seek independent financial advice. A qualified mortgage adviser can help you explore your options and determine if a retirement interest-only mortgage fits your needs.

What is a Lifetime Mortgage?

A lifetime mortgage is a type of equity release secured against your home. It allows you to access tax-free cash while staying in your property.

Lifetime mortgages are available to homeowners aged 55 or older. For the Payment Term Lifetime Mortgage, eligibility starts at 50. You can take the money as a lump sum or in smaller, multiple amounts over time.

The loan is typically repaid when you die or permanently move into long-term care. However, you can repay part or all of the interest if you wish. This reduces the interest charged over time and lowers the final repayment amount.

A lifetime mortgage can help if you need to pay off an existing mortgage, fund essential home improvements, or gift money to loved ones.

What is a Retirement Interest Only (RIO) Mortgage?

Interest-Only Mortgage for Later Life

A Retirement Interest Only (RIO) Mortgage is available for people aged 55 or older. This type of mortgage is secured against your home. Borrowers are required to pay monthly interest, which ensures the loan amount remains the same over time.

This type of mortgage can be used for various purposes, including repaying an existing mortgage. Additionally, the loan does not need to be repaid until you or the last borrower passes away or moves into long-term care.

It’s essential to note that a RIO Mortgage must be arranged through a qualified mortgage adviser. This ensures you receive tailored advice suited to your financial circumstances and goals.

Would you like more information on how this works or who it might benefit?

FAQs on Later Life Mortgages

What is a later-life mortgage?

A later-life mortgage is a financial product designed for individuals typically aged 55 or older. It allows homeowners to unlock equity from their property or access mortgage options suitable for retirement. Options include Retirement Interest-only (RIO) mortgages or equity release schemes.

How does a Retirement Interest Only (RIO) mortgage work?

With a RIO mortgage, you pay only the interest on the loan each month. The loan amount remains the same over time. Repayment is due when you, or the last borrower, pass away or move into long-term care.

What is the difference between an RIO mortgage and an equity release?

RIO mortgages involve regular monthly interest payments, while equity release schemes (such as lifetime mortgages) do not require monthly payments. With equity release, interest is rolled up, and repayment occurs when the property is sold after death or moving into care.

Who is eligible for a later-life mortgage?

Eligibility criteria vary by lender but generally include:

- Aged 55 or older.

- Owning your home outright or with a small mortgage balance.

- Sufficient income to meet affordability checks (for RIO mortgages).

Can I use a later-life mortgage to repay an existing mortgage?

Yes, many borrowers use later-life mortgages to pay off an existing mortgage, especially interest-only mortgages reaching maturity.

Do I retain ownership of my home with a later-life mortgage?

Yes, with products like RIO mortgages, you retain full ownership of your home, unlike some equity release plans.

What can I use the funds from a later-life mortgage for?

Funds can typically be used for various purposes, including home improvements, helping family members, or supplementing retirement income.

Do I need a financial adviser for a later-life mortgage?

Yes, a qualified mortgage adviser is essential. They help assess your needs, explain the risks, and recommend suitable options.

Are later-life mortgages regulated?

Yes, the Financial Conduct Authority (FCA) regulates RIO mortgages and equity release schemes, ensuring customer protection.

What are the risks of later-life mortgages?

Risks include potential impact on inheritance, affordability of repayments (for RIO mortgages), and reduced equity over time. It’s crucial to understand the long-term implications before proceeding.

Would you like assistance finding a mortgage adviser or exploring these options further?

Why Contact us?

We are proud members of the Equity Release Council, qualifying us to provide expert equity release advice. This should give you peace of mind when discussing later-life mortgage options.

Contact Us