Are you looking for mortgage brokers in West Mersea to help with buying your first home or securing a better deal? West Mersea, on Mersea Island in Essex, combines coastal charm with a strong community, making it a desirable place to live.

Finding the right mortgage can be challenging, especially with so many options available. A mortgage broker in West Mersea can simplify the process by comparing deals from different lenders. Whether you’re a first-time buyer, remortgaging, or looking for a buy-to-let mortgage, expert advice can save time and money.

Interest rates, lender criteria, and affordability assessments all impact mortgage approval. Professional brokers understand the UK mortgage market and can guide you through the process. They assess your financial situation, recommend suitable products, and handle applications efficiently.

West Mersea’s property market offers various options, from coastal cottages to modern homes. Local brokers have insight into lender preferences and the best deals for buyers in the area. They can also assist self-employed applicants, those with complex income, or anyone needing specialist mortgage advice.

Working with a broker means access to exclusive rates and tailored advice based on your needs. Since lenders update criteria frequently, having expert support ensures you find the most competitive mortgage. A broker can also help with paperwork, reducing stress and improving approval chances.

If you’re considering a move to West Mersea or want to refinance, speaking to a mortgage expert can help. Understanding mortgage terms, fees, and repayment structures is essential to making informed decisions. The right broker ensures you secure the best deal for your circumstances.

Coastal Charm and Community Spirit

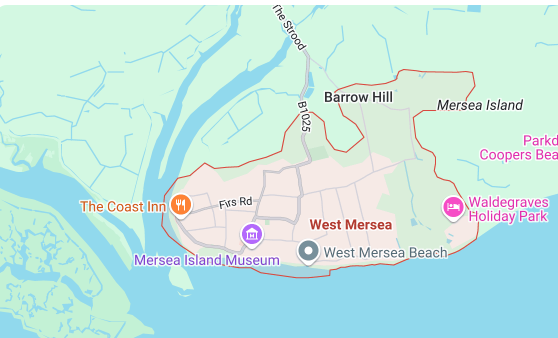

West Mersea is renowned for its beautiful beaches, picturesque countryside, and rich history. The town has a strong sense of community, with local events and activities that unite residents.

Diverse Housing Market

The housing market in West Mersea offers a range of properties, including modern apartments and family homes. Property prices are competitive compared to areas closer to London, making it an attractive option for various buyers. Over the past year, the average property price in West Mersea was £477,208. Detached properties sold for an average of £577,006, semi-detached properties for £326,455, and flats for £255,688.

Convenient Transport Links

West Mersea is connected to the mainland by a road called the Strood, which can flood at high tide, so planning your travel is essential. The town is approximately nine miles south of Colchester, providing access to larger city amenities. Bus services connect West Mersea to Colchester, making commuting straightforward.

Community and Amenities

West Mersea offers a range of schools, healthcare facilities, and recreational options. The town centre features various shops, cafes, and services catering to residents’ needs. Local attractions include the Mersea Island Vineyard and Cudmore Grove Country Park, offering opportunities for leisure and relaxation.

How Mortgage Brokers in West Mersea Can Help

Understanding mortgage options can be complex. A local mortgage broker provides tailored advice and access to a wide range of lenders. Whether you’re buying your first home, remortgaging, or exploring later-life mortgage options, a broker can save you time and often secure better deals.

Key Benefits of Using a Mortgage Broker:

Expert guidance tailored to your financial situation.

Access to exclusive mortgage deals not available directly from lenders.

Assistance with paperwork and managing lender requirements.

Advice on government schemes like Help to Buy or Shared Ownership.

Check out our guide: “How Mortgage Brokers Simplify the Homebuying Process.”

For homeowners aged 55 and over, equity release or later-life mortgages can provide financial flexibility. These options allow you to access the value tied up in your property to fund retirement, home improvements, or support your family.

Equity Release Options:

Lifetime Mortgages: Borrow against your home’s value while retaining ownership. Repayment is made when the property is sold.

Home Reversion Plans: Sell a portion of your home to a lender in exchange for a lump sum or regular payments while continuing to live there rent-free.

Later-Life Mortgages:

These plans are designed for older homeowners who wish to borrow while retaining full ownership. Popular options include interest-only mortgages, which allow you to pay interest during the term and repay the capital when selling the property.

Nearby Towns to Consider

While West Mersea is an excellent choice, nearby towns like Tiptree, Colchester, and Brightlingsea also offer great living options. Exploring these areas can provide broader insights for clients seeking mortgage advice.

Tiptree

Tiptree offers a more affordable housing market and better transport links. However, it lacks the coastal charm of West Mersea.

Colchester

Colchester provides better amenities and public transport options, though you’ll sacrifice some of West Mersea’s tranquillity.

Brightlingsea

Brightlingsea offers a variety of attractions and is known for its vibrant community. It’s a nearby town worth considering for its unique offerings.

Plan Your Move with Mortgage Brokers in West Mersea

West Mersea is a unique and welcoming town that combines affordability, charm, and convenience. Whether you’re buying your first home, remortgaging, or exploring equity release, the right mortgage brokers in West Mersea can help you secure the best deal and achieve your property goals.

Ready to Get Started?

Contact our team today if you’re looking for expert mortgage brokers in West Mersea. We’re here to guide you through the process, offering tailored solutions to suit your needs and budget.

Take the next step towards your dream home in West Mersea confidently and easily.